May 18, 2020 Free accounting software is automated cloud or desktop technology that allows business owners and financial professionals to manage a small business’s books for free through their computer. Of course, even the best free software won’t be your most powerful accounting software options. Free small business Accounting software that's really easy to use. EasyBooks accounting software is a simple, easy to use accounting program designed specifically for small businesses in South Africa. Download the Easybooks free accounting software or read on for more information about the EasyBooks accounting software package. Accounting Made Simple: Accounting Explained in 100 Pages or Less Part of: Financial Topics in 100 Pages or Less (10 Books) by Mike Piper Jan 1, 2013 4.5 out of 5 stars 1,130. EasyBooks is Ideal for small businesses and 'one man bands', this app allows you to keep track of all your accounts, including bank accounts, sales and purchase invoices, expenses, earnings and assets (including depreciation). For bank and credit card accounts, you can reconcile your statements in the app. Entering information is easy and quick. Amazon.com: Accounting Made Simple: Accounting Explained in 100 Pages or Less (221): Piper, Mike: Books.

In today’s hyper-competitive world, many small businesses don’t have the resources to hire an accountant or an accounting firm to meet all of their financial needs. Through a combination of internet resources and the abundance of books on accounting basics to choose from, many small business owners or people are looking to improve their financial literacy. With that in mind, we created a list of the best books on accounting basics. This list of books is designed for readers without an accounting or financial background who want an introduction to accounting by experts in the field. To create this list, we considered the number of Amazon reviews (the more reviews, the higher on the ranking) in conjunction with the average review rank. The books with the best review rank and the most reviews made our Top 10.

1. Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports

This basic accounting best-seller serves as a great introduction for non-financial managers, stock-market investors, undergraduate and MBA students, and more. Without dumbing down the concepts, Thomas R. Ittelson’s step-by-step guide walks us through the three basic types of financial statements: the balance sheet, the income statement, and cash flow. By balancing clear explanations of these three accounting basics with necessary accounting principles, Ittelson crafts a book designed for small businesses and non-accountants. Inasmuch, Financial Statements gives readers from every walk of life a great introduction to the 3 core financial statements and how they relate to one another. In pairing clear definitions with visual examples, Ittelson ensures his reader can understand how to measure their company’s financial health. For the non-accountant, this book is a must-read to improve financial literacy.

2. Accounting Game: Basic Accounting Fresh from the Lemonade Stand

In a world where even non-financial jobs require familiarity with certain financial concepts, Accounting Game by Darrell Mullis and Judith Orloff is a must read, especially for small business owners. Using the sustained example of a lemonade stand, Mullis and Orloff explain the basics of finances, including common financial jargon and documents. Through running their own lemonade stand, readers learn basic financial literacy, including concepts like assets, liabilities, earnings, inventory, and notes payable. Designed for someone without any accounting background, Accounting Game reviews three core financial statements by gradually building on knowledge established from previous chapters. In the end, this accounting book is one every small business owner needs on their shelf.

3. Accounting for the Numberphobic: A Survival Guide for Small Business Owners

(AMACOM/American Management Association, 3 September 2014)

Dawn Fotopulos, author of Accounting for the Numberphobic, demystifies 3 small business financial statements: the Net Income Statement, Cash Flow Statement, and the Balance Sheet. With particular focus on understanding the information and implications of each document, Fotopulos’ book outlines a path for small business owners to take control of their company’s finances. Through several case students, this accounting book improves its readers’ financial literacy in growing profits, measuring cash flow, financial sustainability, and overall company value. For anyone without a finance background and in need of accounting basics, this book is a must-read.

4. Accounting Made Simple: Accounting Explained in 100 Pages or Less

Mike Piper’s Accounting Made Simple is a quick overview of basic accounting principles. Because of its well-defined chapters and chapter summaries, Piper’s book is also a great reference to return to after an initial read. In easily digestible writing, Piper explains several accounting basics, such as how to read and prepare financial statements, but also how to calculate different financial ratios, deprecation, and amortization. Accounting Made Simple also covers concepts behind Generally Accepted Accounting Principles (GAAP) and the Accounting Equation without any technical jargon. That means readers finish Piper’s book not only know how to digest and create basic accounting statements, but they also have a basic understanding of some of the theories behind those statements.

5. Accounting All-in-One For Dummies

Written as a one-stop reference guide for students and accounting professionals, Accounting All-in-One for Dummies is a valuable addition to any small business owner’s bookshelf. Author Joy Kraynak gives a comprehensive breakdown of many accounting concepts, including setting up an accounting system, recording transactions, adjusting entries, preparing income statements and balance sheets, creating budgets, and much more. While it covers a lot, Accounting All-in-One is a great book for basic accounting knowledge or as a refresher for the more experienced.

6. Accounting: For Small Businesses QuickStart Guide – Understanding Accounting for Your Sole Proprietorship, Startup, & LLC

Designed with the small business owner in mind, this QuickStart guide by ClydeBank Media, offers a book with an easy-to-read format. Accounting: For Small Businesses guides readers to learn basic accounting principles, including the relationship between assets, liabilities, and equity, and creating and using financial statements. This book goes one step further to include clear explanations, with examples, of detecting and preventing fraud, record optimization, and accrual vs. cash accounting. That means this accounting book improves its reader’s holistic financial literacy. ClydeBank Media is so confident in their review of accounting basics that they even offer a 100% money-back guarantee.

7. Fundamental Accounting Principles

First published in 1975, Fundamental Accounting Principles is now on its 19th edition! For over thirty years, this book has been the standard for financial accounting. Fundamental Accounting Principles uses clear and technically accurate language that uses the Student Success Cycle educational principle that encourages learning rather than memorization. That means accounting basics are slowly built upon one another throughout the book with relevant and easy-to-understand examples. Each new edition updates content and examples so readers can be sure they are getting the most up-to-date information on basic accounting principles.

8. Accounting, 6th edition (Barron’s Business Review Series)

Peter J. Eisen’s Accounting familiarizes students with basic accounting terms, the accounting equation, financial statements, and transaction records. Ideally suited for small business owners that need to establish or brush up on their accounting basics, this book also covered how to close or adjust accounting books at the end of a business period. Besides explain what each of the accounting principles are, Eisen also focuses on clear explanations of how and why each of these principles may be followed. That means students finish Accounting with a well-rounded understanding of basic accounting that improves their overall financial literacy.

9. Accounting: Tools for Business Decision Making, 5th Edition

Books

Accounting: Tools for Business Decision Making by Paul Kimmel, Jerry Weygandt, and Donald Kieso provides reader-friendly introductions to basic accounting principles. Through illustrations, diagrams, and examples, the authors turn basic accounting’s core elements into one easily digestible book. The authors follow a “macro- to micro-” method of discussing each financial statement by first explaining how each type of financial statement communicates aspects about a business’s financing, investing, and operating activities. With updated examples for the 5th edition, this accounting book improves its reader’s financial literacy by clear and thorough explanations of accounting basics.

10. Accounting Principles

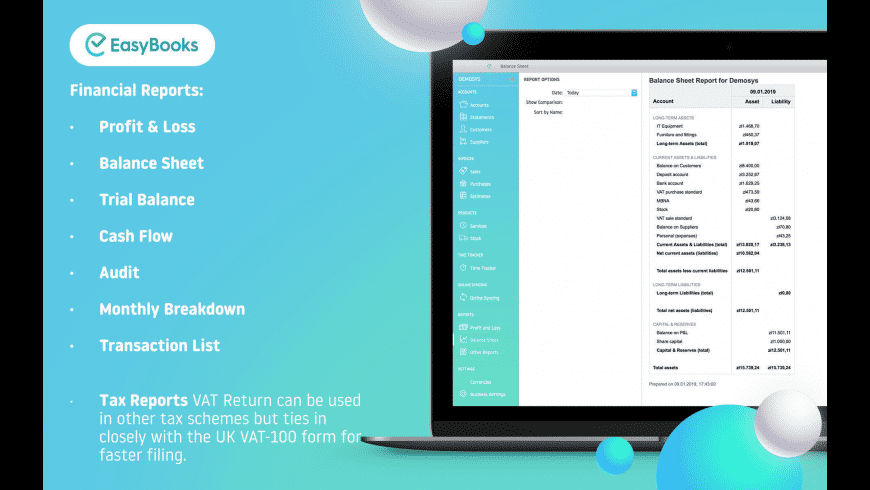

Easy Books Accounting App

Jerry Weygandt, Paul Kimmel, and Donald Kieso’s Accounting Principles lays the foundation for readers to understand basic accounting principles and practices. Written in a clear and conversational style, this accounting book explores key concepts through using the example of PepsiCo’s financial statements. With the book’s real-world examples, readers not only understand how to read accounting documents, but also discover their practical implications. Updated for today’s business world, Accounting Principles improves its reader’s financial literacy through clear definitions, examples, and illustrations. Once readers have a firm understanding of accounting basics, they can move on to later chapters and learn about more advanced, managerial accounting principles.